Maybe you’ve recently spoken to a broker or financial adviser about investments, and they suggested exchange-traded funds (ETFs) as a way to diversify your portfolio and boost your earnings.

But, you don’t know how they work or how to go about adding them to your arsenal of investments. Or maybe you’re just starting out and want to learn more before making an investment decision?

What are ETFs?

ETF is short for ‘exchange-traded fund’. In a nutshell, an ETF is a basket of assets that can include a medley of any of the following:

- Stocks

- Bonds

- Gold and silver

- Currency (domestic and foreign)

- Oil futures

They are ideal for individual investors because they allow you to diversify your holdings without actually purchasing individual shares of each asset. And the profits are generated but the performance of the overall fund, and not individual shares.

Furthermore, they are easily purchased and sold on the exchange, making it simple for investors to buy and sell.

How do ETFs work?

Before ETFs hit the exchange for trading, they must be created by authorized participants or specialized investors. They conduct extensive research and choose the assets that they deem as most suitable for the portfolio.

The pool of assets is then divided into shares and traded on a major stock exchange, like the NYSE or NASDAQ, or through a brokerage firm.

Each ETF has ticker symbol and intraday price that can be tracked throughout the day. But unlike mutual funds or index funds, prices are constantly fluctuating because shares are issued and redeemed throughout the day. (Mutual funds are priced at the end of the trading day so all buyers and sellers receive the same price).

ETFs can be purchased by individual investors, but the way in which returns are generated differs from what you’d see with stocks or bonds. Profits are not tied to the actual assets in the fund, but a sum of the profits generated from interest and dividends from the overall fund. The return is collectively based on your proportion of ownership in the fund.

Types of ETFs

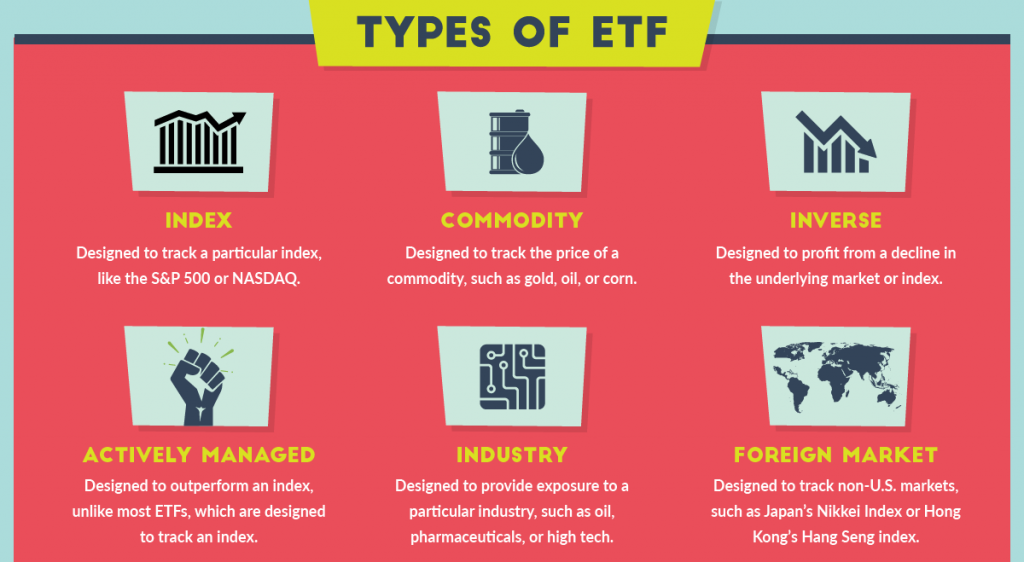

There’s no shortage of ETFs as offerings exist to track an array of sectors, markets, and indexes both here in the U.S. and abroad. Those that are most popular among investors include:

- Actively managed ETFs: the main objective is to beat a particular index

- Bond ETFs: the main objective is to track bond performance.

- Commodity ETFs: the main objective is to track the price of a particular commodity. Common commodity ETFs include gold (GLD), crude oil (USO), and silver (SLV).

- Foreign market ETFs: the main objective is to track markets outside of the U.S.

- Market ETFs: the main objective is to track a specific index. These include DIA (tracks the Dow Jones Industrial Average), Spider or SPDR (tracks the S&P 500 Index) and QQQ (tracks the Nasdaq 100).

- Sector or Industry ETFs: the main objective is to track a sector or industry. Common sector ETFs include XLF (financial companies), OIH (oil companies), FONE (smartphones), and XLE (energy companies).

Benefits of ETFs

Diversified Asset Pool

You can invest with minimal effort to fit your taste in securities, risk tolerance, and investment goals. This also means you can choose from a variety of market segments. Furthermore, poor performing assets can offset those that are performing well.

Hands-off Management

Professional fund managers do all the work for you according to your investment objectives. They also continuously monitor the performance of the ETF. But since these investments are generally passive and track an index, your fund manager won’t have to spend a bulk of their time day in and day out managing the fund to stay ahead of the curve.

Quick note: The exception to this rule applies when you’re dealing with an actively managed ETF that is designed to beat an index.

Flexible Purchase and Selling Window

Unlike mutual funds, ETFs are available for purchase at any time of the day. There’s also flexibility with orders as you can choose from buy on margin, limit or stop-loss orders. Even better, those no minimum holding period, like you’ll see with some mutual funds, so you’re free to sell at any point after you purchase shares.

This added flexibility is also beneficial to investors because it minimizes the level of risk they’ll have to absorb in the event the market takes an unexpected turn for the worse. They’re much easier to unload in a shorter window than mutual funds that sometimes have a 30-day holding period before they can be sold.

Tax benefits

With mutual funds that are taxable, you must pay taxes on distributions regardless if you keep the cash or use it to invest in more shares. However, you will only pay taxes on ETFs when your investment is sold.

Transparency

As mentioned earlier, the performance of a particular ETF can be tracked throughout the day using the ticker. And the end of each day, the fund’s holdings are shared with the public. But mutual funds only disclose this information on a monthly or quarterly basis.

Lower Administrative Costs

Unless the ETF is actively managed, your administrative costs will be substantially lower than what you’d find with a portfolio that must have oversight at all times, like a mutual fund. On average, administrative costs for most ETFs are lower than .20 per year, compared to the 1 percent or more per year in administrative costs that accompany mutual funds, according to Nasdaq.

But keep in mind that these figures aren’t the same across the board. So, it’s best to speak with the issuer to get a better idea of what you’d expect to pay in administrative costs should you decide to invest in their ETFs.

Drawbacks of ETFs

Before you invest in ETFs, there are some drawbacks you should be mindful of.

Price Fluctuations

Prices change often, so you could be at a disadvantage if you like to buy in small increments. And it’s not always possible to buy low and sell high if the ETF is a slow mover.

Fees from Commissions

Looking to buy ETFs through an online broker? If you select an ETF that’s outside the scope of what they offer, you could incur substantial fees from brokerage commissions.

Sudden Death

If the fund underperforms and is forced to shut down abruptly, you have no control over the hit you may take through, either through a loss on your investment or tax obligation.

Settlement Window

When you sell ETFs, there’s a two-day settlement window that must pass before you can access your cash. This could be to your disadvantage if need the funds right away to invest in another asset.

How to Invest in ETFs

Getting started is as simple as opening a brokerage account, funding your account through a settlement fund, and selecting the ETFs you’d like to purchase.

Reputable companies to consider include BlackRock, Vanguard Group, State Street and Charles Schwab. You can also view a comprehensive list of online options for brokers here.

Bottom Line

It’s easy to buy or sell ETFs. By gaining a thorough understanding of how they work and working with a broker to analyze how they will impact your investment portfolio, you’ll have the best chance of maximizing your returns.